- What your need to know about buying a foreclosed home

- Just how do home foreclosures really works?

- Variety of foreclosures

- Money a beneficial foreclosed house

- Cons of buying a foreclosed home

- A long time techniques with paperwork

- Family reputation questions

- Race

- Pros of buying a foreclosed home

- Bargain pricing

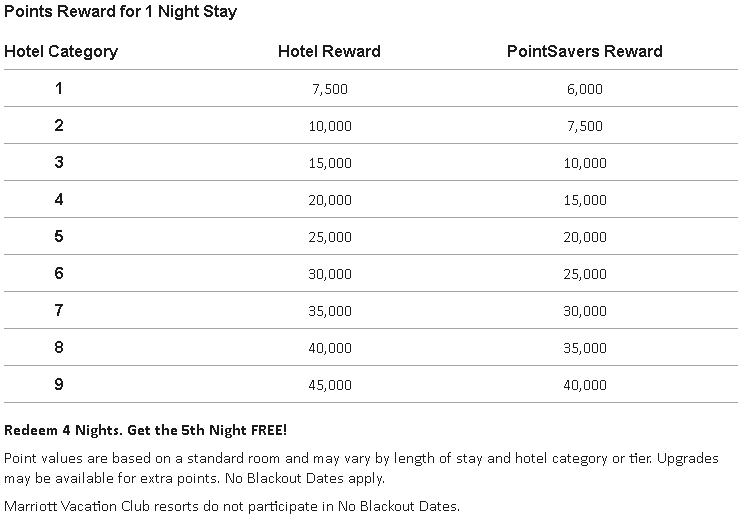

- Financing possibilities

- Make wise a house financial investments in partnership with Fall in

You will find foreclosed land into the just about any housing market in the united states, and buying a good foreclosed house was smoother adopting the middle-2000s financial crisis. Pursuing the moratorium for the foreclosures, as a result to the COVID-19 pandemic, finished when you look at the , people asked an increase in property foreclosure. not, we are nevertheless seeing a small supply and you can significant race. The very best extra in the to buy a great foreclosed residence is will cost you, but volatile timelines, repairs, and you will strong race could possibly get dissuade you against to invest in a beneficial foreclosed family.

There are some variety of property foreclosure: pre-property foreclosure, brief income, sheriff’s marketing, bank-owned, and you will authorities-owned. All version of foreclosures possess unique attributes, and also the purchase techniques may differ. Envision going for an agent who’s regularly new property foreclosure techniques. They will be capable give you specific understanding according to the feel.

How do home foreclosures functions?

Whenever a holder cannot generate money on their financial, the lending company takes arms of the home. The lending company usually sends a notification from default immediately following 90 days of overlooked costs. Have a tendency to, the fresh resident contains the possibility to plan for a new payment bundle into the lender up until the home is offered. If you’re to get good foreclosed home, youre purchasing the family throughout the financial, perhaps not the newest residence’s completely new manager.

Style of foreclosure

Pre-foreclosure: As the owner is during standard on their home loan, he could be informed from the lender. Should your citizen are selling the house in the pre-foreclosures months, they may be able avoid the property foreclosure process and some of one’s has an effect on on the credit score.

Brief conversion process: When the a homeowner are lasting monetaray hardship, they could to market their house in the a preliminary selling. The lending company has to agree to deal with quicker toward possessions than the newest citizen currently owes on the home loan. Quick conversion process will be very long as bank needs to work and you can accept the deal.

Sheriff’s deals: Sheriff’s sales is auctions kept immediately after people default to their funds. This type of deals try triggerred by local the authorities, and that the name sheriff’s product sales. Throughout these auctions, the home is available into high bidder.

Bank-possessed features: In the event the property doesn’t sell from the auction, it gets a real house holder (REO) possessions. The mortgage bank, financial, otherwise financial individual has the home, and they kind of features are sometimes often referred to as bank-owned house.

Government-possessed attributes: The same as REO services, these domestic was first bought having fun with an enthusiastic FHA otherwise Virtual assistant financing, each other regulators-back fund. When these types of services try foreclosed and do not sell at public auction, they become bodies-manager qualities. Following, he or she is marketed from the agents who do work with respect to the fresh company and this approved https://cashadvanceamerica.net/installment-loans-sc/ the loan.

Financial support an excellent foreclosed house

When you find yourself all the dollars even offers deliver your most significant advantage whenever buying a great foreclosed family, individuals capital choices are readily available for investment properties. Understand that personal lenders is less inclined to financing the purchase regarding an effective foreclosed domestic. So you’re able to facilitate the procedure, consider choosing a loan provider and getting pre-acknowledged getting a mortgage.

If you’re wanting to get a property foreclosure, we recommend examining the government-sponsored investment solutions to the people who meet the requirements. A good 203(k) loan is a type of investment provided by the Federal Casing Administration (FHA). There are several different varieties of 203(k) funds. Possible fundamentally getting billed home financing insurance premium in order to counterbalance the bank’s chance. you will discover interest levels of these style of money are about 0.25% higher than antique finance.