To order property the very first time was a vibrant milestone, particularly in South carolina, where housing industry has the benefit of different alternatives for this new home owners. Be it the brand new allure of seaside metropolitan areas like Charleston or even the more enjoyable feeling from inland organizations, South carolina brings a varied list of locales of these searching to settle down. For first-time homeowners, navigating the path so you’re able to homeownership involves understanding the local home landscape, getting ready economically into buy, and you may examining the various homebuying software and you can mortgages offered to assist all of them.

Into the Sc, prospective property owners try met which have information built to make clear the fresh buying process. These are typically informative applications to aid in understanding the complexities off a property transactions, plus financial help solutions that assist with off repayments and settlement costs. It is necessary for first-date people to grasp these power tools and you can functions to ensure they are making informed choices. By the carefully thought each step-of monetary preparing so you can selecting the right mortgage and you may understanding the buy process-buyers normally position on their own getting a successful and you may worry-free changeover on homeownership.

Key Takeaways

- Sc also provides diverse a house alternatives and you may info for very first-date homebuyers.

- Monetary maturity and comprehension of advice software are essential steps in the latest homebuying trip.

- An educated approach to in search of loan choice and you may navigating the fresh new to order processes ensures a smoother transition to homeownership.

Understanding Homeownership inside the Sc

Navigating the journey of getting property into the Sc, specifically for basic-day homebuyers, relates to understanding the regional real estate market, the newest rewards away from home ownership, and the essential words included in a home deals.

South carolina Real estate Overview

Southern Carolina’s real estate ily property so you’re able to townhomes, providing to various tastes and you may costs. To own earliest-big date homebuyers, it is vital to observe that the house purchases rate you are going to will vary rather across different nations. Homebuyers inside the South carolina can frequently select less expensive prices versus almost every other says, for the purchase price limitations becoming a critical foundation for several homebuyer assistance programs.

Benefits associated with Homeownership

Homeownership into the South carolina includes multiple masters. Running an initial household can offer a sense of balance and the potential for property value really love. Property taxes for the Sc is actually apparently all the way down, which will be a plus getting home buyers. Working with a representative may also render earliest-big date consumers having pro information through the intricacies of process.

Trick Home Terms

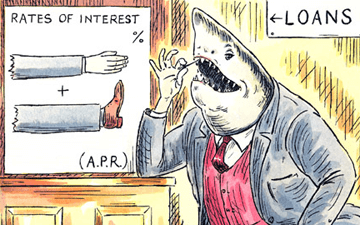

- Mortgages: That loan secure by the property getting ordered, generally featuring certain words and you will rates.

- Fixed Rates of interest: Such pricing continue to be an equivalent from the life of the mortgage, often preferred because of their predictability.

- Downpayment Direction: A program that can help earliest-time people cover the first can cost you away from a purchase.

Financial Preparation getting Very first-Day Homeowners

Reaching the think of homeownership inside South carolina starts with financial maturity. That it thinking pertains to https://elitecashadvance.com/personal-loans-ms/ a comprehensive comparison of profit, understanding the part regarding credit scores, finances mode, and ultizing available instructional tips.

Assessing Your bank account

Including a peek at possessions, established bills, and you can money. An important metric in this analysis is the personal debt-to-income proportion (DTI), which ought to preferably getting below 43% to improve the chances of loan approval.

Insights Credit scores in addition to their Effect

Credit scores is actually critical to the house purchasing processes. Less credit history may cause large home loan prices, affecting overall value. South carolina homeowners is always to strive for a credit rating more than 620 to qualify for most readily useful costs and you can software, for example down-payment advice given by Sc Property.